Everyone knows taking the trades in the lower time frame is one of the most difficult tasks in the world. If you want to build your life in the trading industry, you must learn to focus on the important variables of the market. Once you start analyzing the key factors of the market, you will give a second thought to deal with the lower time frame trade signals. Still, some traders prefer to trade in the lower time frame as it gives them a better trading opportunity in the options market.

In this article, we are going to discuss four amazing rules which will allow you to trade the lower time frame like a pro trader. Go through this article as it will change your life and let you trade the market in a disciplined way.

Study the chart pattern

You might be thinking that the chart pattern trading strategy is designed to trade in a higher time frame. But this is not all true. If you do the proper research, you will realize chart pattern trading strategy is often used by short-term traders. If you learn to deal with the major chart patterns in the options market, you should be able to make wise decisions at trading. Never expect to win most of the trades from the market. Follow a conservative method while dealing with the major chart patterns.

While studying the chart pattern, focus on the continuation pattern. By doing so, you will eliminate many complexities from this market. You might be thinking that you can earn a big amount of money by mastering this technique but this is not all true. However, you should be able to avoid many false trading signals.

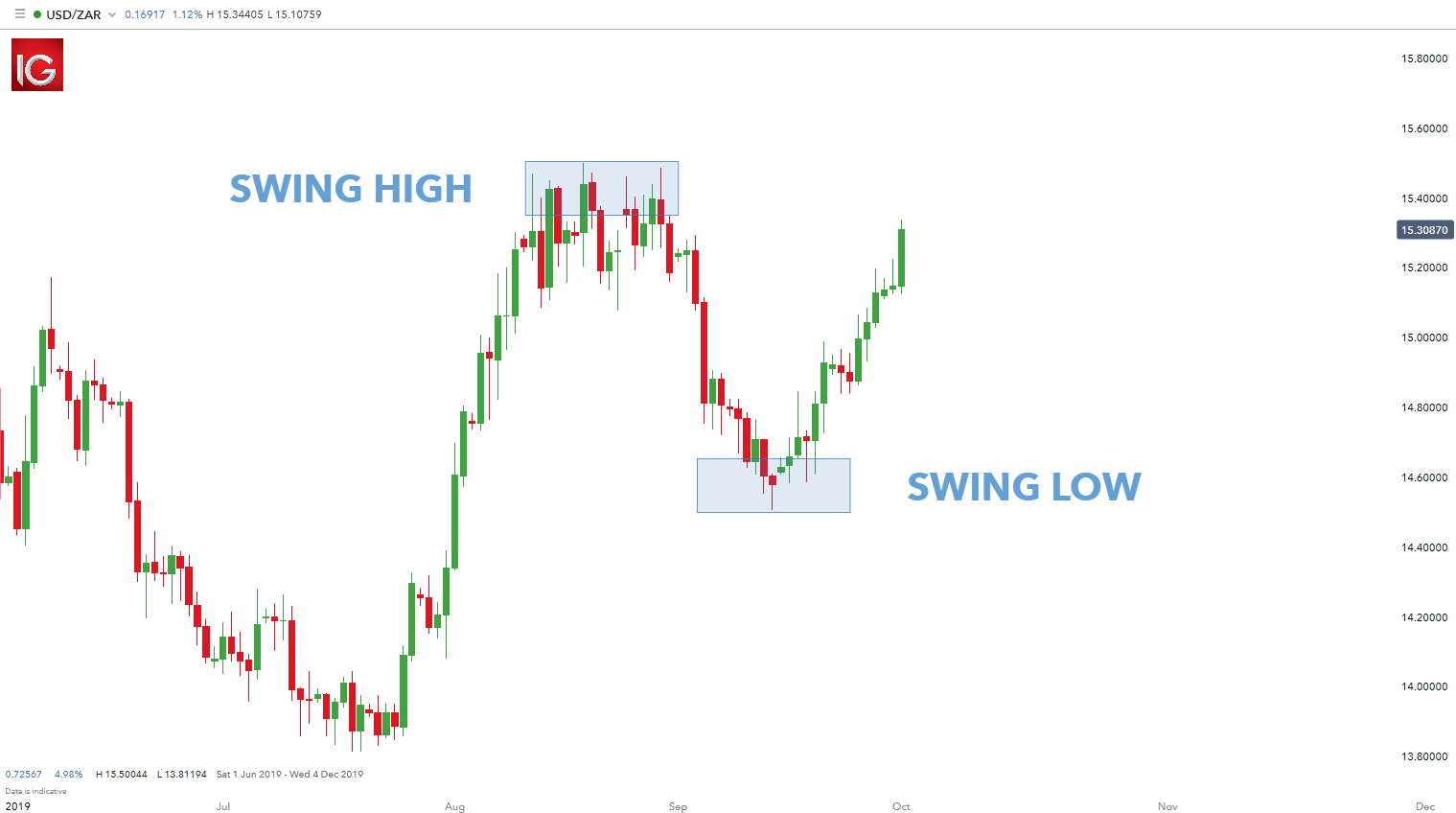

Study the candlestick pattern

The elite traders at Saxo capital markets always trade the market based on candlestick patterns. They know it is one of the most effective ways to make a profit in the retail trading industry. You might think you know the proper way to analyze the candlestick pattern but this is not entirely true. If you wish to succeed in the retail trading industry, you must study the basic formation of the Japanese candlestick pattern. Once you become good at analyzing the major candlestick pattern in the options market, you will become much more confident with your trade execution process.

Lower down the risk exposure

Since you will be taking the trades in a lower time frame, you should be extremely cautious with your risk management policy. A small mistake during the trade execution process can wipe out your entire account balance. In every trade, you should be risking only 1% of the account balance. At times, you might think you can trade with high risk but this is nothing but an emotional response. No matter how convincing the trade setup is, you should not trade this market with high-risk exposure.

As you become skilled in doing the data analysis, you might start trading with 2% risk exposure. But remember, if you trade with high risk, you have to be more cautious about your trade execution process. This will allow you to earn more money and let you execute quality trades.

Trade with the trend

You need to master trend trading strategy as it is one of the most effective ways to make a profit in the long run. If you fail to take the trades with the major trend, you will keep on losing money. Try to use the Fibonacci retracement tools from the start. It will allow you to ride the trend with a high level of accuracy. While using the Fibonacci retracement tools, try to use the multiple time frame analysis processes as it will give you a better picture of this market. But never expect that you will keep on winning just because you are trading with the major trend.